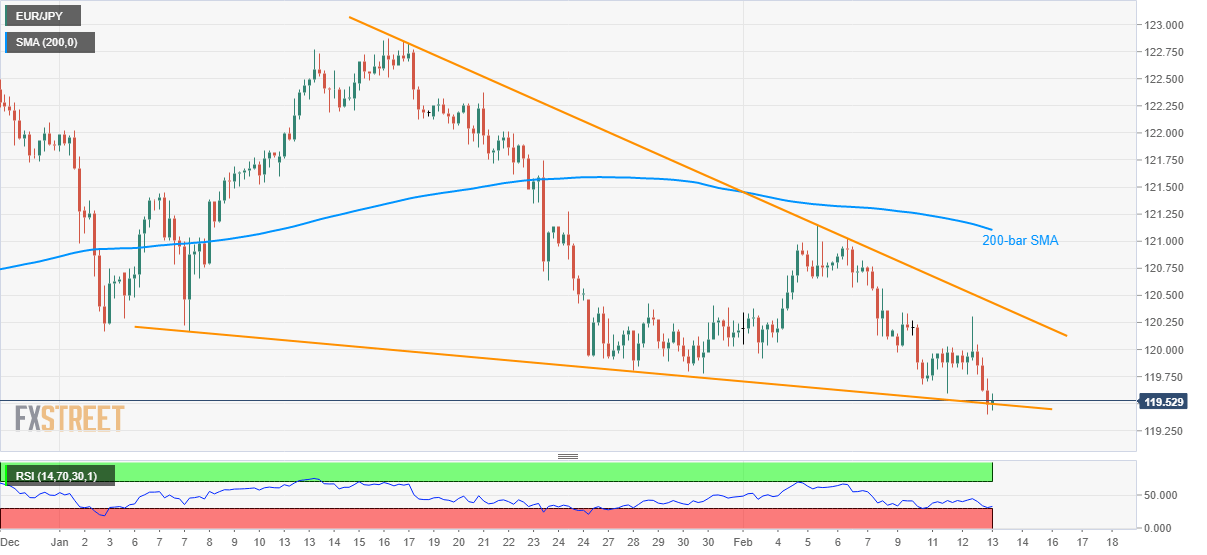

EUR/JPY Price Analysis: Oversold RSI keeps short-term falling wedge intact

- EUR/JPY trades near the lowest in three months.

- A sustained break of the latest low can recall November month bottom.

- A 200-bar SMA will check buyers following the confirmation of a bullish pattern.

EUR/JPY seesaws around the fresh three-month low of 119.40, currently near 119.53, by the press time of early Thursday.

The pair recently dropped below an upward sloping trend line since mid-October but is struggling to defy the short-term bullish formation amid oversold RSI conditions.

As a result, sellers will wait for the quote to trade below the latest bottom near 119.40 to take aim at November month low of 119.25, October 15 trough of 119.12 and 119.00 round-figure.

Should there be sustained trading below 119.00, early-October 2019 high near 118.15/10 could please the bears.

Alternatively, 120.00 can check the pair’s pullback from multi-day low ahead of pushing the quote towards the formation’s resistance line, currently around 120.45.

Even if the break of 120.45 will theoretically confirm the pair’s run-up beyond 122.00, 200-bar SMA near 121.10 could question the optimists.

EUR/JPY four-hour chart

Trend: Pullback expected