Back

13 Feb 2020

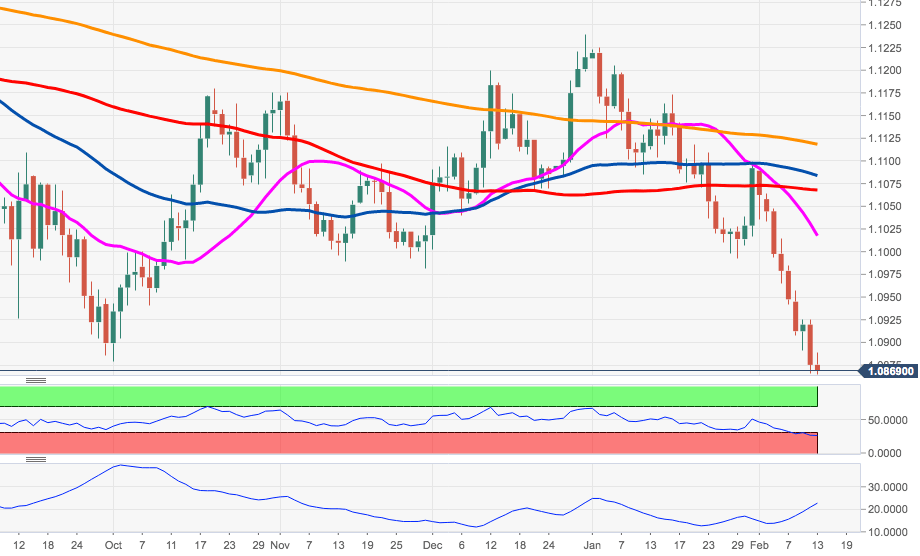

EUR/USD Price Analysis: Further downside could see a test of 1.0814

- EUR/USD keeps the negative view below the 1.0900 mark.

- Extra losses remain on the cards and could extend to 1.0814.

The offered stance in EUR/USD looks everything but abated so far, with sellers now pushing through 2019 low at 1.0879 to trade in levels last seen in April 2017 near 1.0860.

The increasing selling bias has now opened the door to a potential visit to the Fibo retracement (of the 2017-2018 rally) at 1.0814.

In the broader picture, while below the 55-day SMA, today ay 1.1076, further downside should remain well on the table. Interim resistance levels, however, emerge in the 1.1051/61 band, where sit the 100-day SMA and the immediate resistance line (off December’s high near 1.1300).

EUR/USD daily chart