Back

9 Mar 2020

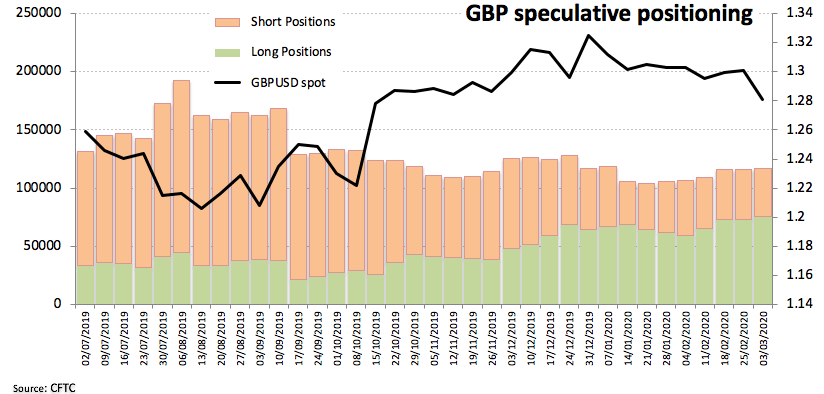

CFTC Positioning Report: GBP net longs at nearly 2-year highs

These are the main highlights of the latest CFTC Positioning Report for the week ended on March 3rd:

- Net longs in the British pound climbed to the highest level since late April 2018, as speculators kept adding gross longs in response to the (so far) steady BoE, some encouraging data in the domestic docket as of late and speculations of fiscal stimulus to be announced at the UK Budget later in the week.

- JPY net shorts kept receding during last week in response to rising safe haven demand, all against the backdrop of coronavirus fears and investors’ preference for the Japanese currency when comes to safety.

- Net shorts in EUR shrunk to 3-week lows following the stretched positioning in the past week. The likeliness of further easing by the Federal Reserve at the March meeting coupled with the March 3rd rate cut sustained the dollar’s sell-off in favour of the European currency.